- Home | Industry Update | Ontex Posts 3% Revenue Growth In First Half Of 2024...

Ontex Posts 3% Revenue Growth in First Half of 2024

The revenue of the Belgian company Ontex increased by 3% in the first half of 2024

In the first half of 2024, Ontex reported a revenue of â¬916 million (approximately $991 million), reflecting a 3 percent increase on a like-for-like basis. This growth was primarily fueled by a significant 11 percent rise in adult care sales, which effectively offset the declines of 2 percent in baby care and 3 percent in feminine care due to pricing pressures. Currency fluctuations did not have a significant net impact, resulting in an overall revenue growth of 3 percent compared to the first half of 2023, and a 1 percent increase relative to the second half of the previous year. Volume sales increased by 5 percent, including mix effects, driven by robust double-digit growth in North America and in certain product categories.

The significant rise in North America stood in stark contrast to the generally stable demand for baby care products in the region, thereby underscoring Ontexâs market share gains. These gains were attributed to new contracts that commenced in the latter half of 2023, the first quarter of 2024, and at the conclusion of the second quarter. Additional volume growth throughout the year will be bolstered by further secured contracts. The year-on-year comparison was partially influenced by customer destocking that occurred in the first quarter of 2023, which resulted in lower order levels during that period.

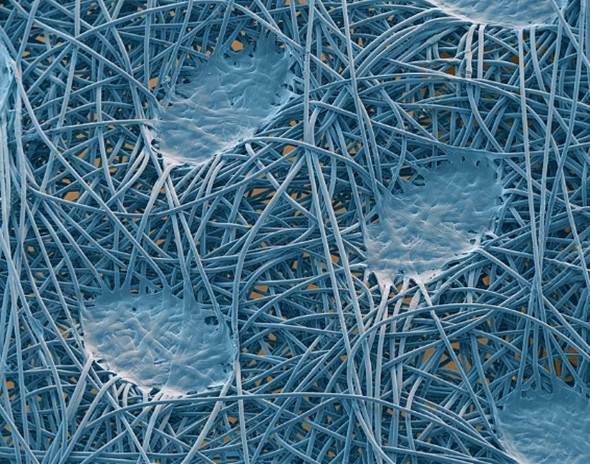

In Europe, the overall demand for baby care products has declined, whereas the demand for feminine care products has remained stable and the adult care segment has experienced growth, consistent with demographic changes. Although promotional efforts by established brands have mitigated the prior market share gains of retail brands in the baby diaper sector, these retail brands continue to excel in the baby pants category as well as in feminine and adult care products. According to a press release from Ontex, the company's sales volumes in Europe mirrored these market dynamics, showing a decrease in baby diaper sales alongside significant growth in baby pants and adult care, particularly within the healthcare channel.

On average, prices experienced a decline of 2 percent. In specific sectors, such as healthcare, prices have remained largely stable due to the longer-term and more inflexible nature of these contracts. However, in other categories, prices have been decreasing sequentially since the latter half of 2023. This trend was anticipated, considering the earlier reductions in the raw material price index that began earlier that year.

In the first half of the year, we have successfully reached several significant strategic milestones. We completed two divestments, which have further refined our focus on core markets, and our cost transformation initiative has once again yielded substantial efficiency improvements. This consistent performance, combined with our sustainable innovation pipeline, positions us to expand our operations in North America and enhance our presence in Europe, instilling confidence in our ability to achieve a robust year. To further bolster our competitive edge, we have announced plans to restructure our production and distribution activities in Belgium. These initiatives will enable us to strengthen and grow our business sustainably while enhancing profitability and cash flow generation, stated Gustavo Calvo Paz, CEO of Ontex.

Following the strong performance observed in the first half of 2024 and the advancements achieved in Ontex's structural transformation, the management of Ontex has updated its earlier guidance, now anticipating a revenue increase of 4 percent to 5 percent on a like-for-like basis (previously projected as low-single-digit growth). Additionally, the adjusted EBITDA margin is now expected to reach 12 percent, an improvement from the earlier estimate of a range between 11 percent and 12 percent.

02:23 PM, Aug 21

Other Related Topics

.webp)

Industry Update

Union Budget 2026: Giriraj Singh Hails âViksit Bharat Budgetâ Driving Textile Growth...view more

Kolkata Set to Become Textile Sourcing Hub as YARNEX and TEXINDIA Return in January 2026...view more

.webp)

1.webp)

1.webp)

1.webp)

.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

1.webp)

_large1.jpeg)

.png)

.jpg)

1.jpeg)